How wallets can solve crypto’s biggest growth problem: retention?

How wallets can solve crypto’s biggest growth problem: retention?

Wallets face a critical challenge: retaining users. Retention is the golden metric that has the potential to shift the crypto industry from cyclical boom-and-bust growth to sustainable engagement and stickiness. In the broader internet business landscape, retention is what distinguishes truly valuable companies from the rest, driving lower acquisition costs, better monetization, and the potential for virality—a fact well understood in Web2 and essential for Web3 companies to adopt if they aim to thrive.

While the industry has largely focused on “onboarding the next 1 billion users” to crypto, many wallets are “leaking” users who, after buying their first crypto, move it to a cold wallet or forget about it altogether. This creates a significant gap between new users and the builders of dApps across categories like DeFi, social, and more.

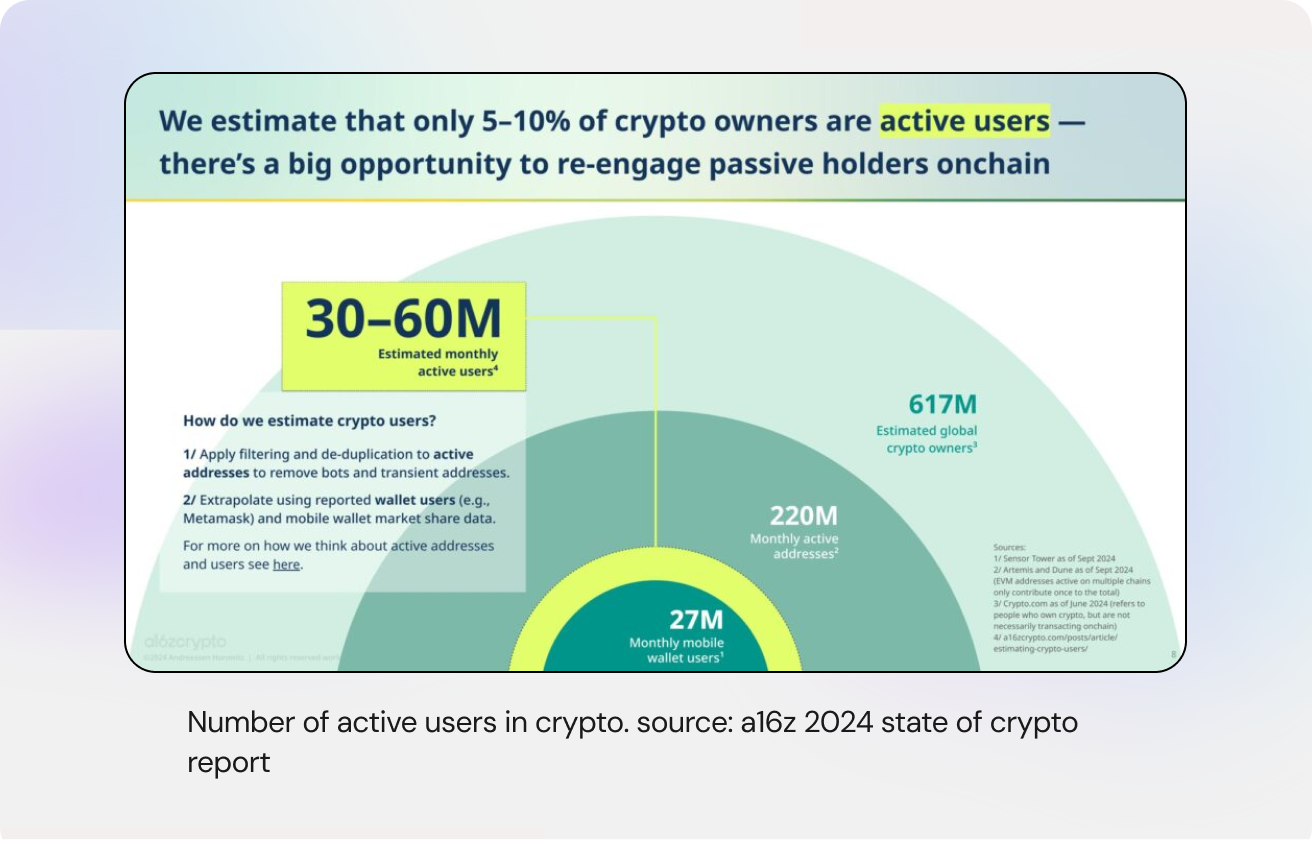

This retention challenge also represents a massive opportunity for onchain transaction growth. According to the State of Crypto Report 2024 by a16z crypto, only 5–10% of people who bought crypto have actively participated in recent onchain activities.

In this piece, we’ll explore how social graph-based recommendations can help wallets and the broader ecosystem of Web3 social apps increase retention and unlock sustainable growth.

Personalization based on user’s social context

Some wallets, such as Rainbow, Zerion, and Coinbase Wallet, are paving the way by recommending trending tokens and mints to their users. However, they need help to surface the content and comments related to these NFTs and tokens. This gap could be bridged by integrating personalized discovery from decentralized social networks like Farcaster, Zora, and Lens.

The opportunity here is to leverage the open social graph being built onchain for curation to show users timely recommendations for things to swap, mint, collect and claim. This is powerful because personalization based on the social context, especially using real-time machine learning like the one used by Web2 powerhouses, can be extremely powerful in driving retention.

For wallets, here’s how this integration could look:

- Social graph-based wallet recommendations: Suggest wallets to watch or follow based on a user’s onchain activity.

- Social graph-based swap recommendations: Suggest tokens and memes for purchase based on insights from a user’s social graph.

- Social graph-based mint recommendations: Suggest NFTs to mint based on insights from a user’s social graph.

- Boost transaction volume by: Offering personalized Frames recommendations tailored to the assets users hold in their wallets.

- Personalized Best-Next Actions: have offers, rewards, or perks for your users, introduced to them in a tailored manner based on their social graph.

This approach also unlocks new monetization opportunities. Wallets can introduce sponsored content, enabling teams, NFT creators, or other stakeholders to promote their content within the app for a fee—transforming wallet attention real estate into a new revenue stream.

Whether or not a user has an existing on-chain social presence, wallets can immediately increase engagement, improve retention, and drive a long tail of transactions by enhancing the user experience with personalized content, transactions, and context-aware notifications.

Not convinced yet? Let’s see how applications have boosted growth and retention with social graph based content and recommendations.

Explosive growth and retention driven by social graph based transactions and content

More and more applications are distinguishing themselves by personalizing user experience based on their social graph, attracting waves of new users and securing network effects thanks to strong retention. Let’s explore three examples that demonstrate how this is playing out in practice.

1. Interface.app

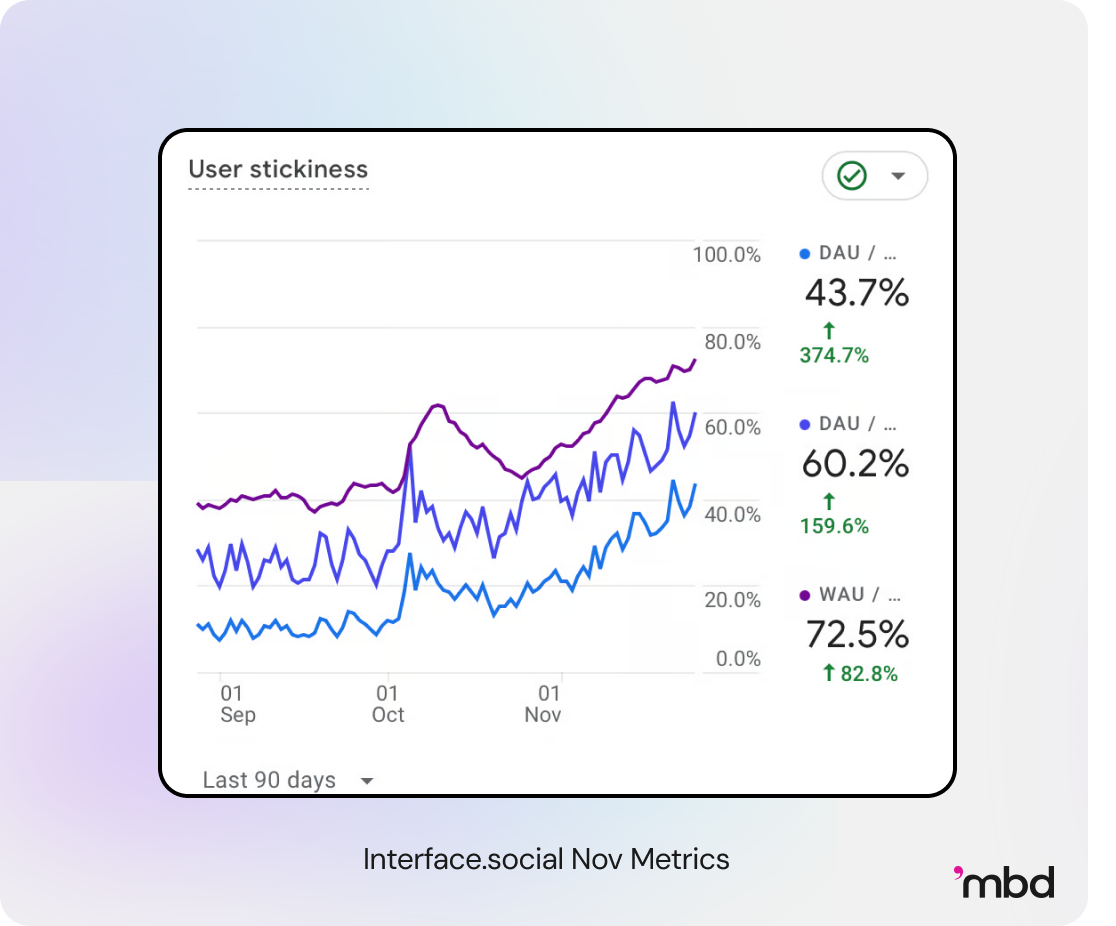

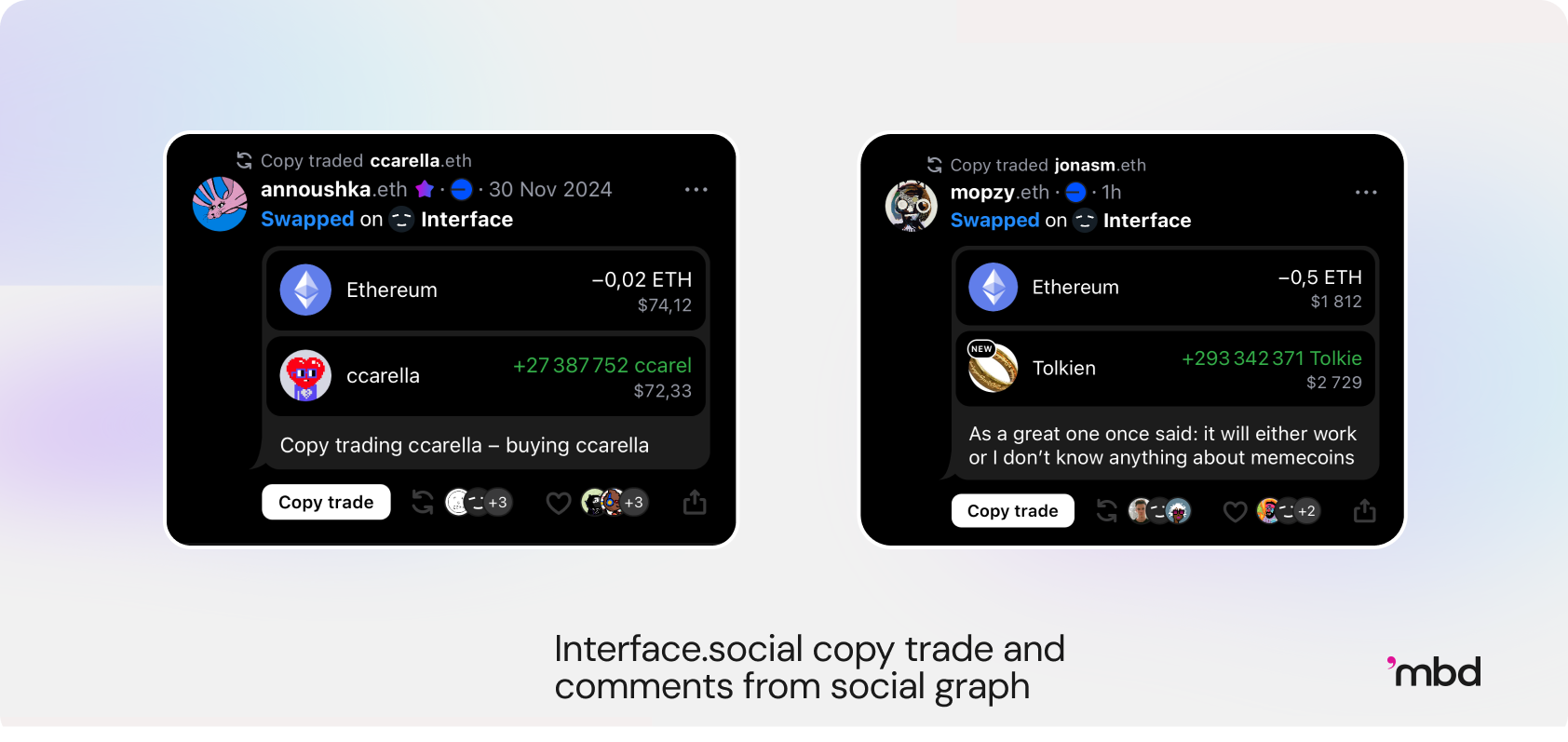

Interface has been developing a transaction feed powered by its social graph for its users. This feed highlights token swaps executed by wallets followed within the app and includes features such as liking, copy trading, and commenting on trades. Users can see who has copy-traded whom, and bootstrap their social network by exploring these relationships. These updates have driven a significant spike in Interface’s growth and retention, as shown in the graph below.

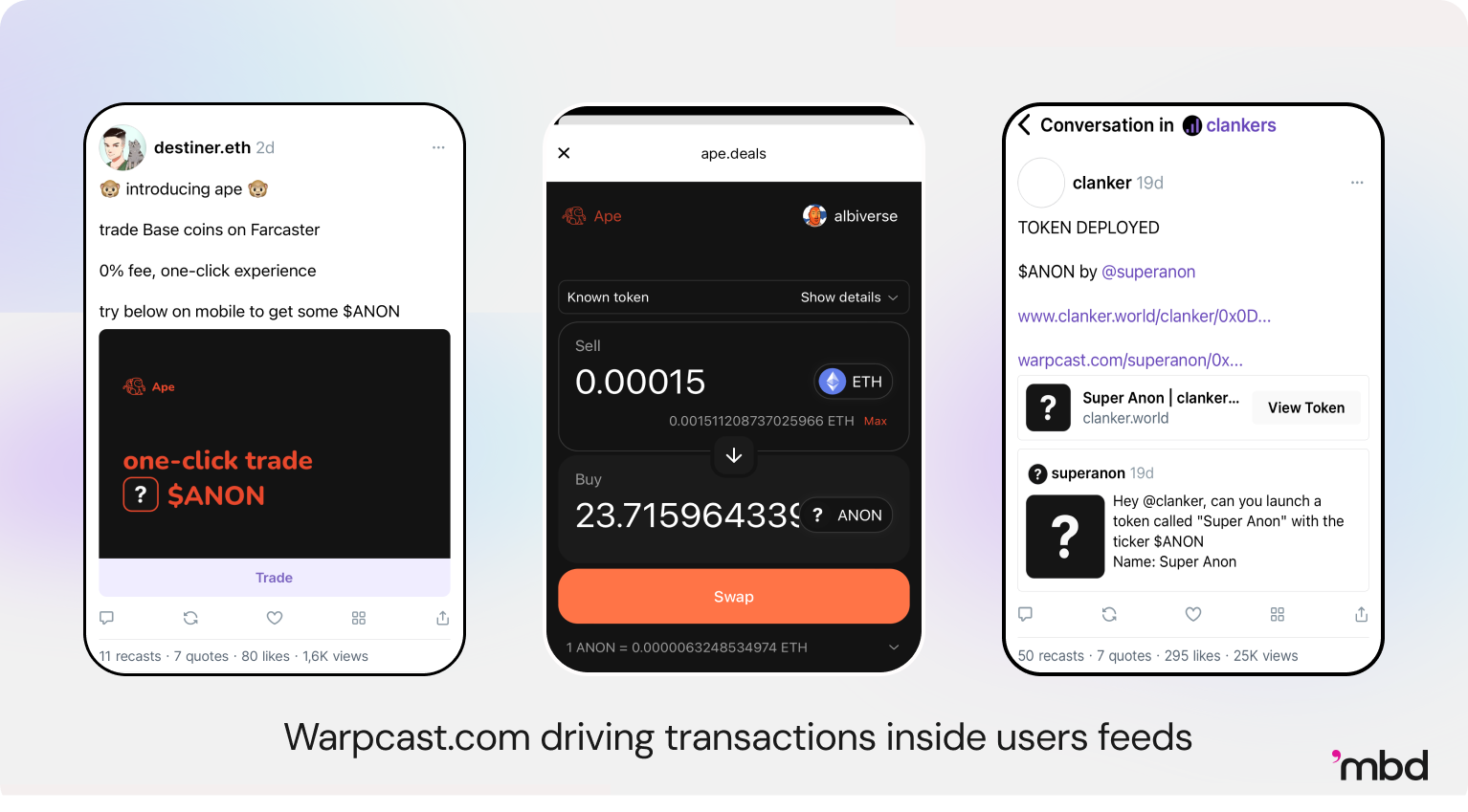

2. Warpcast

Warpcast is a social media client built on top of Farcaster, a decentralized social protocol. In this app, the team first established a social graph before layering crypto primitives on top. In that sense, swap, mints and token recommendations take the form of user generated content like Frames and are pushed to accounts throughout the network through Warpcast’s algorithms like according to Trending or For you.

Over time, Warpcast has managed to retain a strong community of users, constantly innovating and giving life to a quickly growing economy.

A broader trend

These two examples highlight a larger trend in crypto applications: personalizing experiences based on a user’s social graph. On one side, on-chain tools like Interface build their entire user experience around the on-chain activity of people users follow. On the other, social apps like Warpcast integrate assets into a personalized, X-like feed.

The key takeaway? Blending social graph personalization with on-chain activity drives engagement, retention, and growth.

Where can wallets find the social data they need?

Bootstrapping a social graph is complex, resource-intensive, and far from a wallet’s core business. However, wallets don’t need to build their own social graph to push personalized recommendations. Instead, they can integrate directly with social protocols like Farcaster, Zora, or Lens.

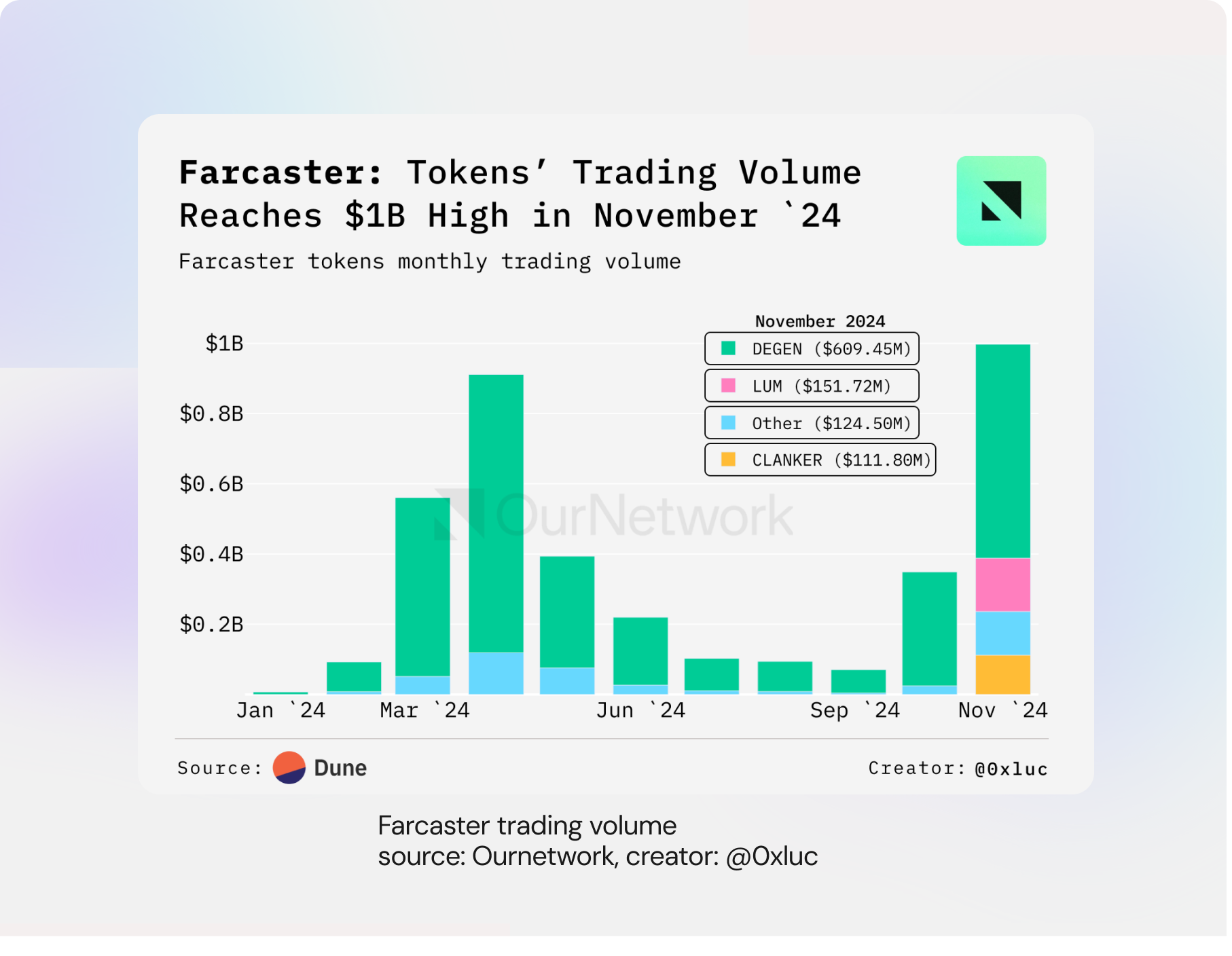

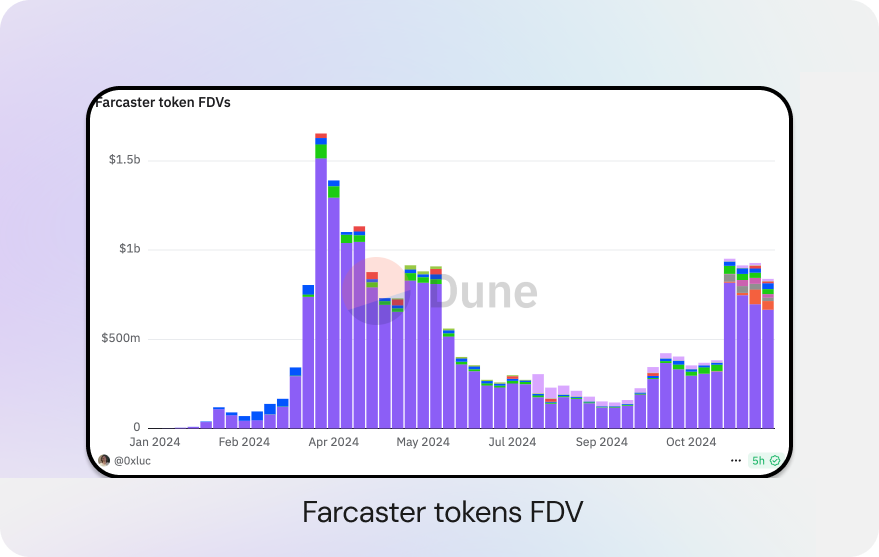

Farcaster is Web3’s answer to X and has already scaled to 700,000+ active users and 500K+ daily posts. The network's economy of tokens and NFTs is booming, with November trading volumes reaching $1B—triple that of October. The best part is that any project can plug into the network and participate.

What sets Farcaster apart—and makes it particularly compelling for wallets—is its decentralized social graph. Key elements are stored on-chain, while others reside on decentralized nodes called hubs. This architecture enables third-party applications and clients to tap into Farcaster’s social graph, and integrate this data seamlessly into their own experiences.

Beyond just Farcaster, the Zora protocol functions as an open graph of NFTs that have been created, minted, and commented on. This can help establish relationships and recommendations that wallets can leverage to surface the most interesting and relevant on-chain content and commentary for their users, tailored to their assets, transactions, and even their Farcaster social graph.

Finally, we’re closely monitoring Lens, which has a unique user demographic, original content, and a distinct technological architecture that could drive rapidly growing use cases in the coming months.

Wallets are the future of social commerce

If we look beyond the horizon and stretch our timeline to a future where crypto and the rest of the internet are tightly intertwined, wallets could become the new bedrock of social commerce.

In social commerce, users engage with content, connect with friends, and make digital or product purchases—all within the same platform. In this paradigm, improved conversion rates and engagement are driven by the power of social proof, community interaction, and personalized content.

This global trend is already gaining momentum. In 2024, Douyin and WeChat will have generated $350 billion in revenue through this model. TikTok (Douyin’s international version), Instagram, and YouTube are following suit, integrating more social commerce features into their platforms.

Web3 apps—and wallets specifically—have a unique opportunity to merge social and financial interactions in ways no other app can, positioning themselves as the “window to Web3” that mainstream users need to embrace decentralized technology. This vision is already starting to play out in Web3.

About ❜mbd

Decentralized networks are still in their early stages, making this space challenging to navigate. At ’mbd, we specialize in deeply understanding this ecosystem and guiding projects through the strategy and implementation of their integrations.

Our AI algorithms deliver fresh, highly relevant on-chain swaps, mints, and content from networks like Farcaster, Zora, and others directly to your users. This enables you to deliver the right content to the right user, driving growth, boosting retention, and pioneering the Web3 experiences of tomorrow.